Why Now Is the Moment for a New Space Revolution

Introduction: The Dawn of a New Space Age

Space exploration and utilization is entering its third great epoch. We stand at a pivotal inflection point - one that promises to be as signifigant as the moment when the first private companies began launching their own rockets. But this time, the revolution isn't just about who builds the vehicles; it's about who uses them, why, and at what scale.

The numbers tell a compelling story: the global space industry now worth $443 billion - about the scale of the Semiconductor market, projected to reach $1.2 trillion by 2030 - comparable to the global automotive industry. But numbers alone can't capture the paradigm shift underway - a shift from government contractors to commercial enterprises, from bespoke systems to mass production, from billions to millions in startup costs.

2025 marks a generational inflection point—where the cost of access to space has collapsed to the point that startups can launch on shoestring budgets, and space is no longer just a frontier, but a platform for exponential growth. Let’s venture into this new era—with historical insight from the prior two Space turning points, and why this one is poised to be of greater impact.

Part I: Space 1.0 — Demonstrating Capabilities in the Cold War Era, Driven Solely by Public Interest

(1957–2000s)

The Cold War Space Race

The first space age began with a beeping Soviet satellite and culminated with footprints on lunar dust. This was Space 1.0 - the era of governmental space programs with essentially unlimited budgets, driven by superpower competition.

NASA's Apollo program alone cost approximately $257 billion in today's dollars. The Space Shuttle program: $196 billion across its lifetime. Projects were measured in decades, not quarters. Innovation happened at a glacial pace through military-industrial complexes with cost-plus contracts that incentivized spending, not efficiency.

"We choose to go to the Moon! We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard." - President Kennedy's famous declaration wasn't just inspirational; it was a blank check.

The accomplishments - spurred by the events of Sputnik and JFK's historic speech - shared by the two warring nation states, were undeniably magnificent. Humanity's first space walk and first steps on another celestial body. The launch of the Hubble Space Telescope. The Mir Space Station and then the International Space Station. And now, the launch of the James Webb Space Telescope that has peeled back the cosmos all the way to the beginning of time. Space 1.0 was a competition of nation-states, replacing war-fighting with the pursuit of scientific knowledge and exploration. But the model was fundamentally unsustainable and inaccessible to anyone outside of superpower governments - at the time, only The United States and the Soviet Union (and later Russia) held a monopoly on access to space.

Part II: Space 2.0 — When Space Went Commercial: TV, Satphones, and the First Tourist Tickets

(2000s–2020)

The Private Sector Enters the Launch Game

Space 2.0 began with a phone call that would change the trajectory of human spaceflight. A South African entrepreneur with PayPal millions and a seemingly outlandish dream cold-called Jim Cantrell, one of the world's foremost experts on Russian rockets.

"I'm Elon Musk," the voice on the line said. "I want to change the world, and I need your help to buy a Russian rocket."

Cantrell, who had once been detained by Russian authorities during his work on international space projects, was understandably skeptical. The plan Musk outlined seemed almost comically ambitious: purchase refurbished ICBMs from Russia to send mice to Mars as a publicity stunt that might rekindle public interest in space exploration.

"It wasn't just naive," Cantrell would later recall. "It was borderline insane."

Nevertheless, Cantrell agreed to join Musk on a trip to Russia. After several frigid meetings in Moscow that ultimately went nowhere (with one Russian engineer reportedly spitting on Musk's shoes), they returned empty-handed. On the long flight home, something shifted.

"I think we can build the rocket ourselves," Musk said, naively scribbling calculations on the back of a napkin long before Cantrell and others were able to give him a crash course in literal rocket science.

That moment of frustration and inspiration led to the founding of SpaceX. Cantrell helped assemble the initial team, bringing on propulsion expert Tom Mueller and eventually Chris Thompson, a veteran aerospace engineer who would become crucial to SpaceX's manufacturing operations and later its Director of Vehicle Structures.

Thompson's expertise in aerospace manufacturing processes proved invaluable as SpaceX moved from the relatively modest Falcon 1 (which failed three times before its first successful launch in 2008) to the revolutionary Falcon 9. Thompson's leadership in developing manufacturing techniques that slashed costs while maintaining reliability helped transform what had started as Musk's Mars fantasy into the most disruptive force the aerospace industry had seen in decades.

What began as a quixotic quest to send mice to Mars had evolved into something far more consequential: a fundamental re-imagining of how rockets could be built, by whom, and at what cost.

SpaceX fundamentally changed the equation by proving that private companies could build and operate launch vehicles at a fraction of the cost of government programs. The Falcon 9's development cost of approximately $300 million represented a 100x reduction compared to government programs of similar capability.

Blue Origin, Virgin Galactic, Firefly Aerospace and others followed, collectively creating a new ecosystem where:

- Private capital, not tax dollars, funded development

- NASA became a customer, not a builder

- Fixed-price contracts replaced cost-plus arrangements

- Reusability entered the mainstream

This era saw launch costs plummet from $65,000 per kilogram to as low as $2,700 per kilogram to low Earth orbit. The Falcon 9 achieved reliability rates that matched or exceeded government systems. And for the first time, access to space began to democratize.

But there was a ceiling to Space 2.0. While launch providers were commercial enterprises, their primary customers remained government agencies and large defense contractors. The true commercial potential of space remained largely untapped.

Part III: Space 3.0 — The Age of Totally Connected Earth: Commercial Demand Drives Global Coverage and Real-Time Awareness (2020s–Present)

From Government Customers to Diverse Commercial Markets

We've now entered Space 3.0 - where the private sector isn't just building rockets; it's becoming the primary customer and service operator of space assets.

This transition is evident in our market analysis showing that commercial communications now represents a $18.2 billion market with nearly 6,000 satellites in orbit - dwarfing government science missions, and similar in scale to the entire smart wearable market. While much smaller in size, the fastest-growing segments - space tourism (15.8% CAGR), on-orbit servicing (18.7%), and space manufacturing (24.3%) - are all primarily commercial ventures and invest-able opportunities.

The defining characteristics of Space 3.0:

- Private customers outnumber government buyers

- Constellations replace individual satellites

- Manufacturing shifts from artisanal to mass production

- Startups can enter with initial capital of $1-5 million - a typical Seed/Series A

- Value moves from hardware to services and applications

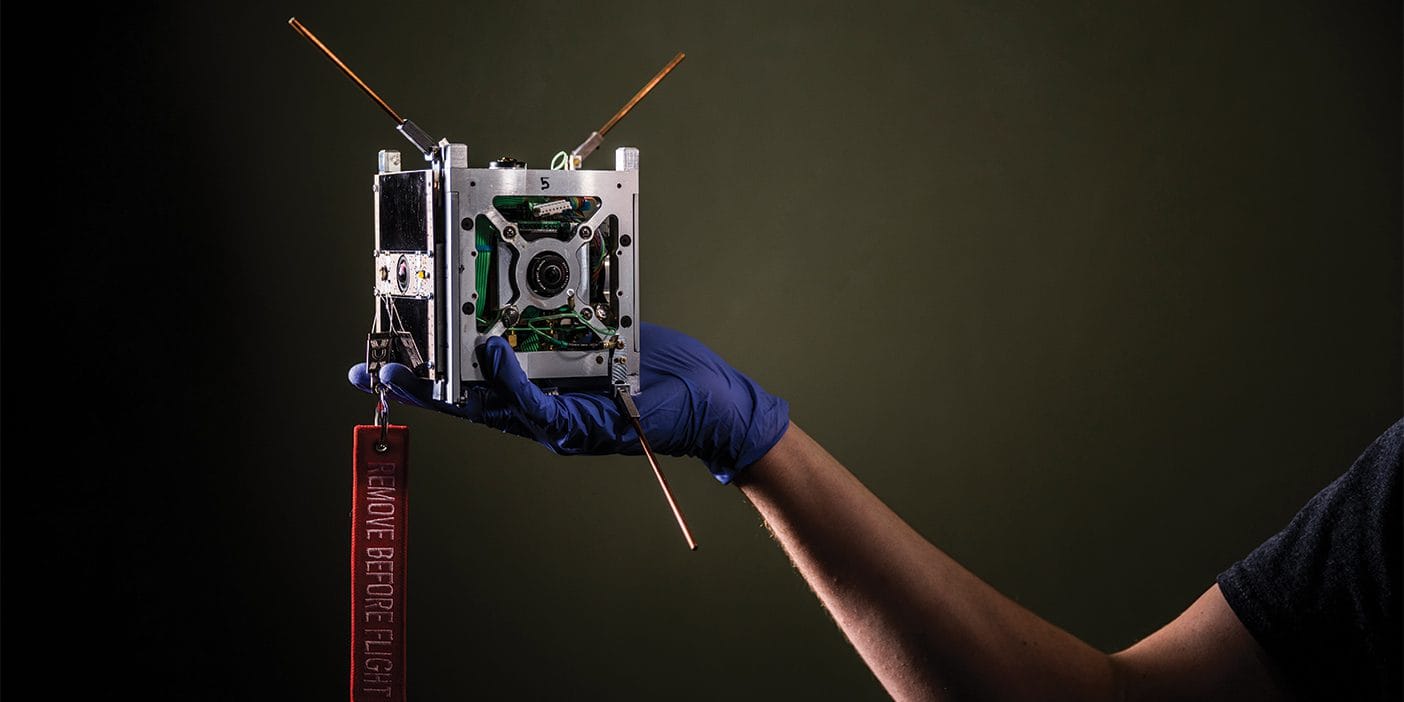

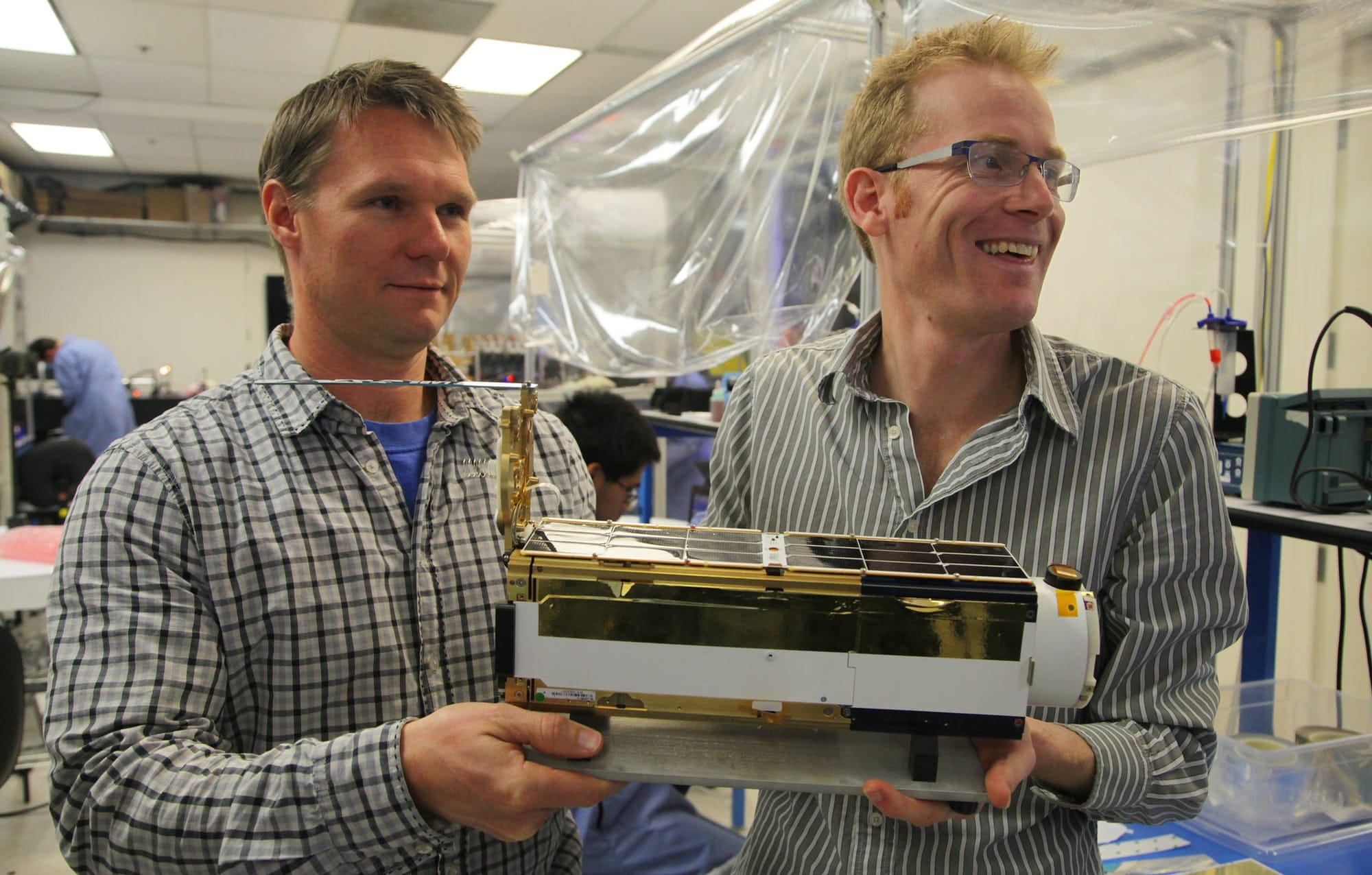

Small Satellites: The Vanguard of Space 3.0

The small satellite revolution exemplifies this transformation. Just as our computers, phones, and smart devices have become dramatically smaller, more powerful, and energy efficient — the same has transpired on orbit.

Small satellites, no bigger than a microwave oven, are now capable of monitoring wildfires that once required manned aircraft flying dangerous, fuel-guzzling missions through smoke-filled skies. Today, real-time streams of high-resolution pixels from orbit can replace human risk with actionable data.

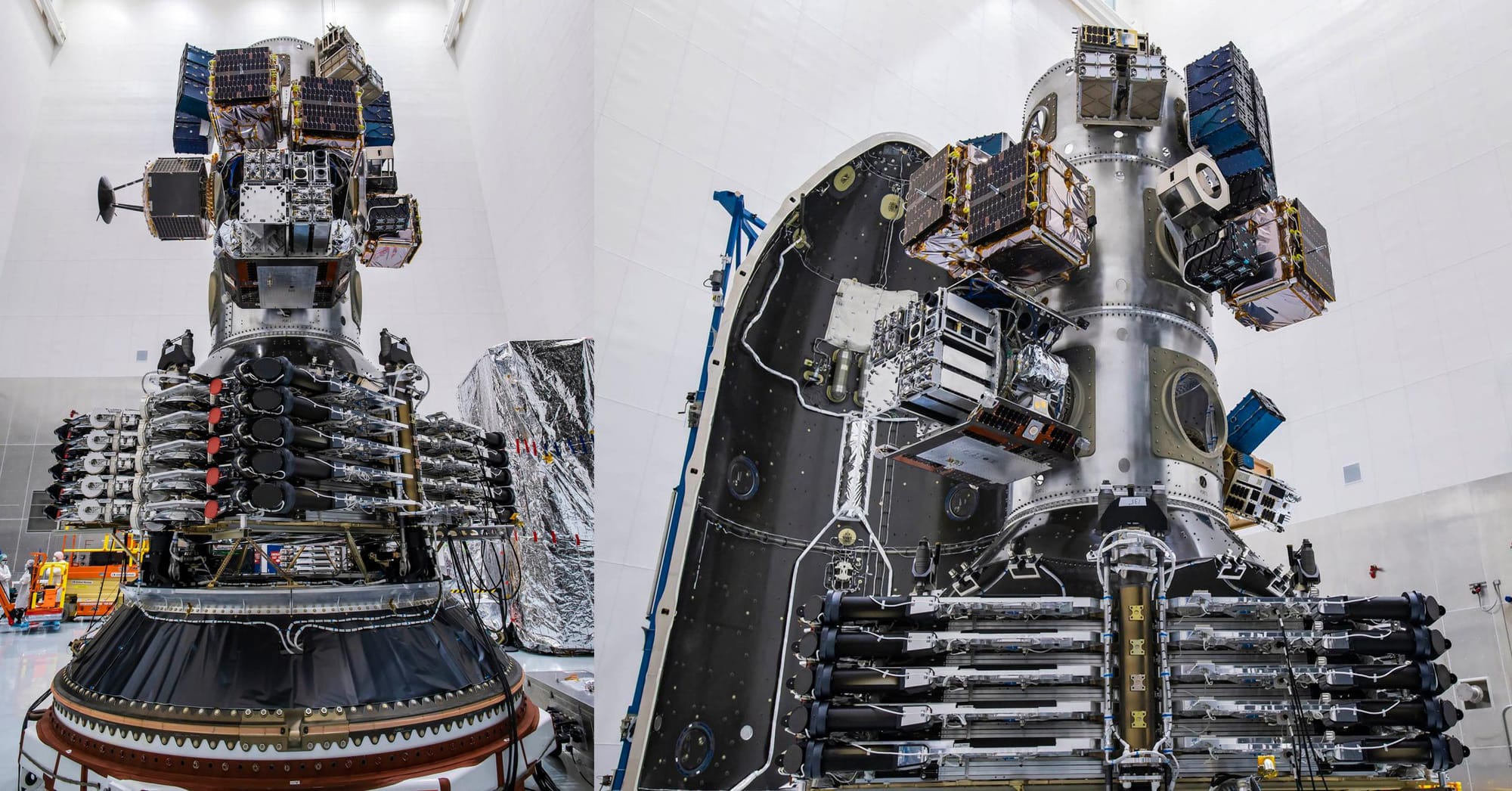

These satellites also serve tens of thousands of wireless users with broadband internet, and provide defense agencies with the intelligence needed to deter conflict before it escalates. No longer content with catching a ride-share on Falcon 9 rockets — the space equivalent of boarding a bus with strangers and surrendering control of your destination — a new generation of space companies demand dedicated launches tailored to their precise orbits and mission timelines.

Despite their small size, they have onboard navigation, solar and power management, sensors, and are capable of doing real science and providing commercial services.

This has catalyzed an explosion in small launch vehicle development. Companies like Rocket Lab and Firefly are developing vehicles specifically sized for this market segment, offering launches in the 300-1000kg range for prices between $5-15 million, and are able to launch monthly.

For context on how revolutionary a dedicated small launch vehicle is: a decade ago, launching a 100kg satellite would cost $10+ million as part of some of the first rideshare missions on Falcon9 - meaning the operator has zero-say in where the satellite ends up in orbit. Today, we are in the nascent era where a dedicated launch can be purchased for similar prices, eliminating the compromises inherent to hitching a ride. However, even this model is about to shift yet again, lowering the price yet another order of magnitude and increasing the frequency of launch of small launch vehicles to daily.

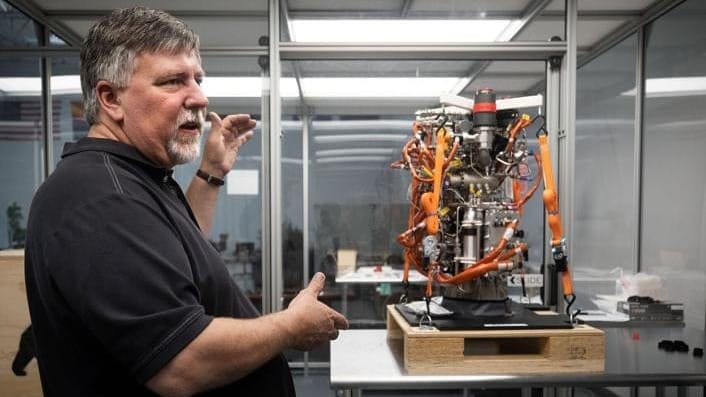

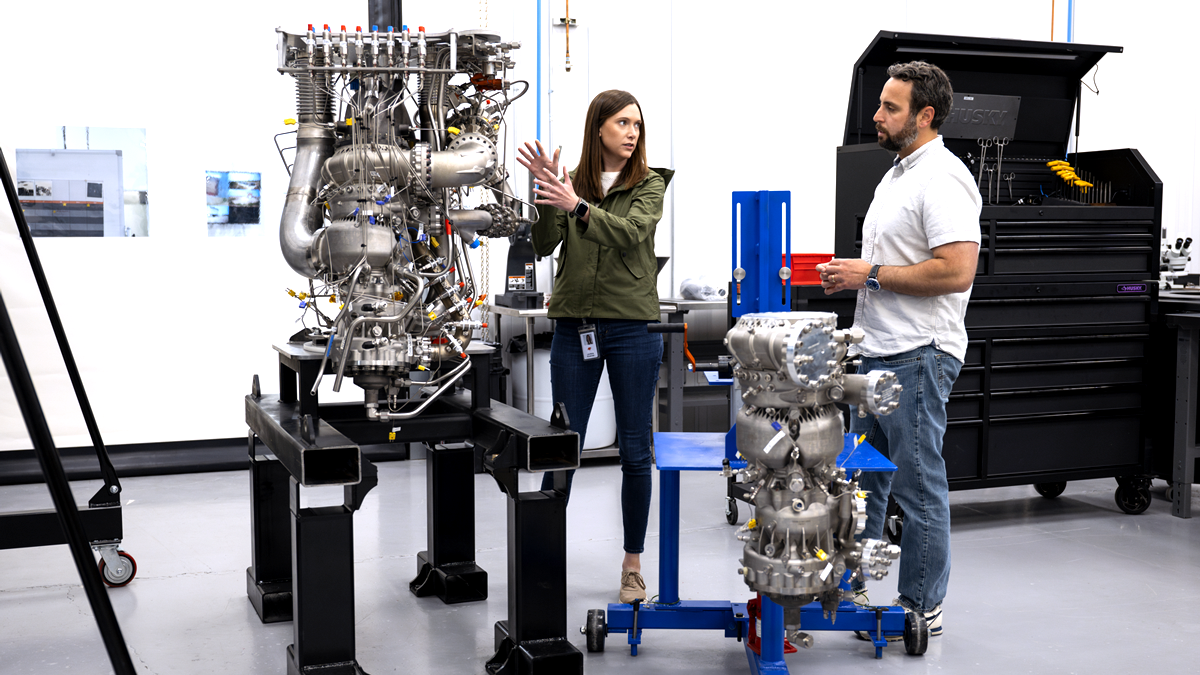

Phantom Space: The Universal Playbook of Launch Success

In what may be the most significant development in the small launch market, Jim Cantrell and Chris Thompson have joined forces to create Phantom Space. What makes their partnership uniquely powerful isn't just their SpaceX pedigree – it's their collective experience across virtually every U.S. launch company in existence.

Between them, Cantrell and Thompson have held key positions at SpaceX, Blue Origin, Virgin Orbit, Rocket Lab, Vector, Firefly, and others. This extensive experience has allowed them to compile what amounts to a universal playbook – understanding not just what works, but precisely why certain approaches succeed where others fail. In aggregate, the Phantom Space team has concentrated expertise in how to make launch affordable for every startup that want's to launch a space business - effectively building the "Model T" of rockets. This unique and pivotal launch service, more importantly, is coming to market just as SpaceX focuses its resources on Starship.

"We've seen every mistake in the book, because we've made most of them ourselves," Cantrell notes with characteristic candor. "That institutional knowledge is impossible to replicate any other way."

This experience has produced a launch vehicle ready for its first qualification flights with a cost structure that redefines industry economics. While competitors measure launch costs in tens of millions, Phantom has engineered a system with a cost basis of just a few million dollars per launch – breakthrough that will democratize space access.

This represents a significant shift that promises to do for Space 3.0 what SpaceX did for Space 2.0. By slashing costs to the single-digit millions, Phantom creates possibilities for satellite deployment that simply didn't exist before.

"What we're building isn't just another rocket company," explains Thompson. "It's a catalyst for an entirely new generation of space businesses that couldn't exist under the previous cost structure."

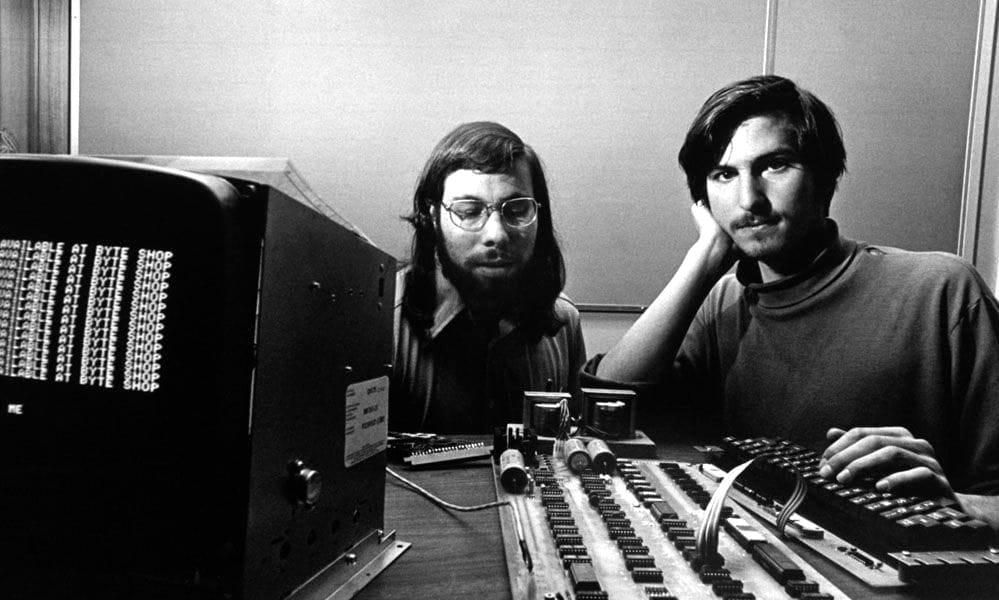

The "Garage" Space Startup Era

As a result of these decreases in costs we've now entered the "garage startup" phase of space where a small team with a compelling idea can raise a $1 million seed round and begin building prototype satellites. Much like the late 1970s, when the cost and availability of semiconductor components made them available to tinkering geeks in garages, startups such as Apple Computers scaled from ramen budget beginings, to become the most valuable companies in history.

Planet Labs started with three engineers building "CubeSats" from consumer smartphone components, and grew to its current ~$1B market cap . Swarm Technologies built a global IoT constellation for approximately $25 million - essentially turning on a global telecommunications network for the price of a private jet, the lowest cost for a global constellation in history. These companies prove that space is no longer the exclusive domain of aerospace giants - starting gun for Garage scale space startups has sounded.

Looking at the emerging commercial landscape, several nascent sectors stand poised for significant growth:

- Mobile Satellite Services/5G-NTN: 11.8% CAGR, Enabling Mobile Network Operators to use their exisitng spectrum to unlock 3 Billion Unconnected people with 5G direct to mobile phone from a small satellite

- Specialized Earth Observation: 8.3% CAGR with higher data pricing at $17,500 per terabyte

- Intelligence & Surveillance: 12.4% CAGR with high-value applications across commercial and defense sectors commanding a premium data price at over $20,000 per terabyte

For entrepreneurs with the right vision, space has never been more accessible. A team can now go from concept to orbit in 18-24 months with capital requirements comparable to software startups a decade ago. But in a few short years, that timeline will shrink to a mere few months for far less capital expenditure.

Part IV: The Future - Space as Software (2025-2035)

The Ultimate Platform

Looking forward, we see Space 3.0 evolving toward a "Space as Software" paradigm that mirrors what AWS and Heroku did for internet applications. Imagine deploying a new 5G coverage region in rural India as simply as deploying a new web service to AWS.

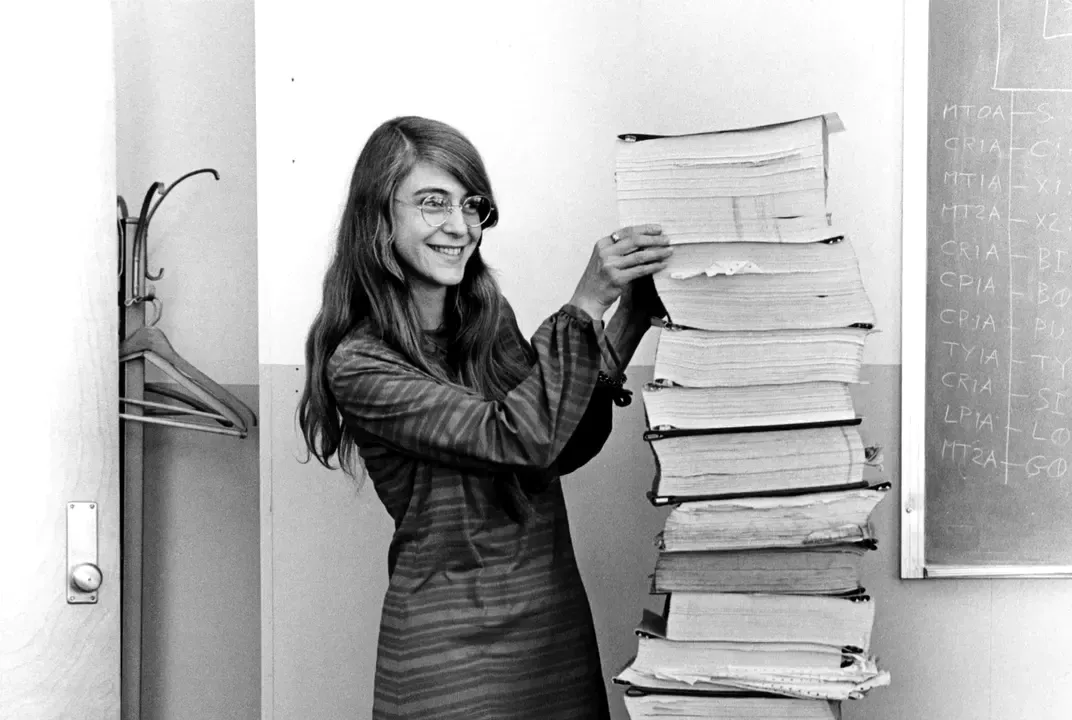

During the Space 1.0 era, the world's first "software engineers" at MIT labored for years to meticulously hand-code the software that would bring humanity to the moon. The code was fragile, difficult to maintain, and required Astronauts to memorize a long list of "verbs, nouns, and program modes" - the total opposite of modern autonomous flight. In the Space 3.0 era, small inexpensive CubeSats autonomously maintain control with little to no human input, and now, their flight software can be rapidly build or even auto-generated leveraging opensource frameworks like NASA's cFS or JPL's F'. Building upon the unprecedented growth in AI generated Software in every market segment of, this is now being rapidly applied to Commercial Space Applications. Imagine what growth and innovation we could see in a future where:

- Entrepreneurs upload code to a global network of programmable satellites from a coffee shop

- New "space apps" deploy globally within minutes, not years

- Satellite infrastructure becomes an abstracted service layer

- Costs drop to the point where even individual developers can afford space capabilities

This isn't science fiction. The foundations are being built today:

- Software-defined satellites with programmable capabilities

- Standardized interfaces for third-party applications

- Cloud-like infrastructure for space data processing

- API-first approaches to satellite control

Just as cloud computing eliminated the need for companies to build their own data centers, Space as Software will eliminate the need for companies to build and operate their own satellites. The focus will shift entirely to applications and services.

The Democratization of Orbital Capabilities

The transformative potential of Space as Software becomes clear when we consider specific applications that will soon be accessible to individuals and organizations without specialized expertise. Let's hop in an imaginary Space Cowboy time machine and fast-forward 5 years to the year 2030, in future tense as though it were now:

- On-Demand Connectivity: A telecommunications startup deploys a 5G-NTN mobile broadband service to a specific region in minutes for tens of dollars per hour with zero capital expenditure. This allows for instant disaster response communications or event-specific coverage without the prohibitive costs of permanent infrastructure.

- No-Code Precision Agriculture: A farmer with no programming experience deploys a micro-service app that monitors crop health, soil moisture, and pest threats across their entire operation, receiving real-time alerts and recommendations based on Earth observation data.

- "SpaceGPT" AI Generated Space Businesses: Combined with the LLM agent revolution and abstraction of the coding layer currently playing out, access to Earth's data and global connectivity has become available to everyone through simple natural language descriptions of their space app. "Show me all urban developments in Southeast Asia over the last three months" becomes an executable command rather than a complex programming task. Imagine - LIVE imagery of anywhere on earth as an app within ChatGPT or Grok.

- Financial Intelligence Integration: An investment bank in New York integrates a custom observation layer of real-time data on crop futures in South America directly into an Excel macro, providing moment-by-moment insights into agricultural production that was previously impossible to obtain in real-time.

- Responsive Military Intelligence: Every intelligence officer in the Department of Defense imagines an intelligence or signals collection application and deploys it in minutes, to measure real-time data with zero coding experience. Thus, Their unit's OODA loop is dramatically accelerated in rapidly evolving situations. When officers have intelligence of capabilities, assets, and deterrence strategies of adversarial nations, wars could be mitigated to short-lived conflicts or potentially eliminated altogether.

- Personalized Climate Monitoring: Environmental researchers deploy custom atmospheric monitoring applications to track specific pollution sources or climate indicators, creating a distributed global monitoring network at a fraction of traditional costs.

- Ad-Hoc Supply Chain Visibility: A logistics coordinator deploy temporary tracking capabilities along specific shipping routes during peak seasons or disruptions, gaining visibility into bottlenecks and optimizing rerouting decisions.

- Emergency Response Coordination: Disaster response teams create situational awareness tools customized to specific events—floods, wildfires, earthquakes—providing detailed mapping and communications services precisely where and when they're needed.

- Instant Infrastructure Assessment: Engineering firms deploy structural monitoring tools to assess earthquake damage across entire cities or monitor the health of aging infrastructure like bridges and dams without installing permanent sensors.

These applications share a common characteristic: they become economically viable only when launch costs drop below a certain threshold and satellite deployment becomes sufficiently responsive. This is precisely the market need that Phantom Space is positioned to address with its revolutionary cost structure and rapid deployment capabilities.

Conclusion: The Investment Imperative

Stepping out of our imaginary Space Cowboy time machine, and setting foot back in the present year 2025, we stand at the threshold of the most significant transformation in space since blank-check budgets of the Apollo program. Today the Space 3.0 coal-face is flush with armies of gritty, greasy glass nerds, hell-bent on bringing Space-borne capabilities to every entrepreneur, every startup, every non-profit, and every nation on earth. The $443 billion industry of today is not only on pace to grow to $1.2 trillion by 2030 but will fundamentally reorganize around commercial applications and services.

For investors, the opportunity is clear: Space 3.0 combines the scale advantages of an established industry with the growth characteristics of an emerging technology sector. The decreasing costs of launch, the miniaturization of satellites, and the growing value of space-derived data create a perfect environment for venture-scale returns.

This isn't just another sector; it's a platform shift comparable to the internet in the 1990s or mobile in the 2000s. Those who recognize this transition early will position themselves to capture substantial value as space becomes truly commercialized.

The Space Cowboy Opportunity

As part of our first Special Purpose Vehicle (SPV), Space Cowboy is opening the door to a novel investment opportunity: Phantom Space. This represents the first of many hand-selected space startups that our team will bring to investors seeking exposure to this burgeoning market.

The opportunity to invest in Jim Cantrell and Chris Thompson's venture is particularly compelling for several reasons:

- Top-tier Industry Experience: Beyond their SpaceX origins, Cantrell and Thompson have amassed a comprehensive understanding of launch technologies through their roles across virtually every major U.S. launch company. This cross-company perspective has enabled them to distill the most effective approaches while avoiding common pitfalls.

- Launch-Ready Technology: Unlike early-stage rocket companies that may be years from flight, Phantom has already developed a launch vehicle that is prepared for its first qualification flights. This significantly reduces technological risk for investors.

- Favorable Economics: With a cost basis of just a few million dollars per launch – a fraction of market rates – Phantom can profitably serve market segments that were previously economically unviable.

- Market Timing: The exponential growth in small satellites creates optimal market conditions for Phantom's right-sized launch solution, with double-digit CAGRs across multiple market segments.

- Enabling the Space as Software Revolution: Phantom's low-cost, rapid-deployment capabilities directly address the current market needs that will accelerate the transition to space as a software platform, positioning the company at the key infrastructure layer of a transformative industry shift.

This initial investment opportunity in Phantom Space is just the beginning. SpaceCowboy will continue to identify and curate investment opportunities across the space value chain – from satellite manufacturing innovations to breakthrough propulsion technologies, from Earth observation analytics platforms to space-based manufacturing opportunities.

By focusing on companies with clear paths to profitability, proven leadership, and addressable markets measured in billions, our portfolio approach will provide investors with balanced exposure to the most promising segments of the space economy while mitigating the inherent risks of frontier technology investing.

What makes this moment noteworthy is its historical parallel. Those who invested in SpaceX's early rounds have seen their investments grow by over 100x. Phantom represents a similar inflection point, but with the added advantage of addressing a now-proven market with lower technical risk.

The garage startups of today are building the space giants of tomorrow. And unlike previous space ages, the barriers to entry have fallen to the point where agile teams with compelling visions can compete effectively.

Space 3.0 is here.

The question isn't whether this revolution will happen, but who will lead it. With Space Cowboy's first investment opportunity in Phantom Space, investors have the chance to back the very pioneers who not only helped create this revolution but have systematically learned from every success and failure across the entire industry.